How to use Price Range

Jupiter DCA has a unique Price Range feature, which in short, allows you to set a minimum and/or maximum price for the DCA order to only execute in.

This feature ensures your orders align with your desired price range, offering better control and flexibility over your trades.

How to set up Price Range?

Navigate to the Jupiter DCA Interface

Once you're on the DCA Interface, set up your order.Enable Price Range

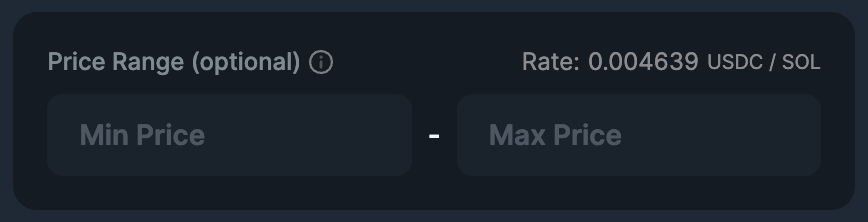

Look for the fields just above theStart DCAbutton. To enable the Price Range, simply set your desired Minimum Price or Maximum Price.

Set Your Minimum and/or Maximum Price

- Min Price: Set the lowest price at which you want the DCA order to execute.

- Max Price: Set the highest price at which you want the DCA order to execute.

- Example

If you set the Min Price to $200 and Max Price to $250 for SOL/USDC, your DCA orders will only execute when SOL is between $200 and $250.

noteDo note that you can set up Min Price and Max Price independently.

Confirm and Start Your DCA Order

Review your price range settings and order details. Once confirmed, start the DCA plan.

When to use Price Range?

Avoid High Prices in Volatile Markets

If the market price of your chosen asset spikes suddenly, Price Range ensures you don’t DCA at undesirably high levels.Capitalize on Buying the Dip

Set a maximum price near recent lows to accumulate assets during a market correction without overspending.Control Long-Term DCA Execution

For extended DCA campaigns, use a reasonable Min/Max range to maintain cost efficiency over time."Trigger Order" Using DCA

Instead of a limit order with 0% slippage since it executes at the exact price, you can use DCA Price Range to enter or exit positions with specific price ranges.

Tips

Use Price Range with a Broader Range in Volatile Markets:

Markets with frequent price swings may require a larger Min/Max price range to ensure your DCA orders can still execute consistently.Combine with Smaller DCA Intervals for Precision:

Setting frequent intervals (e.g., hourly) alongside a price range helps you capture more optimal entry points.Monitor and Adjust as Needed:

Regularly review your Price Range settings to ensure they align with changing market conditions.Avoid Overly Tight Ranges:

Setting a very narrow Min/Max range could result in missed opportunities if prices fluctuate outside your bounds.